Secretarial Fee Tax Deduction Malaysia 2018

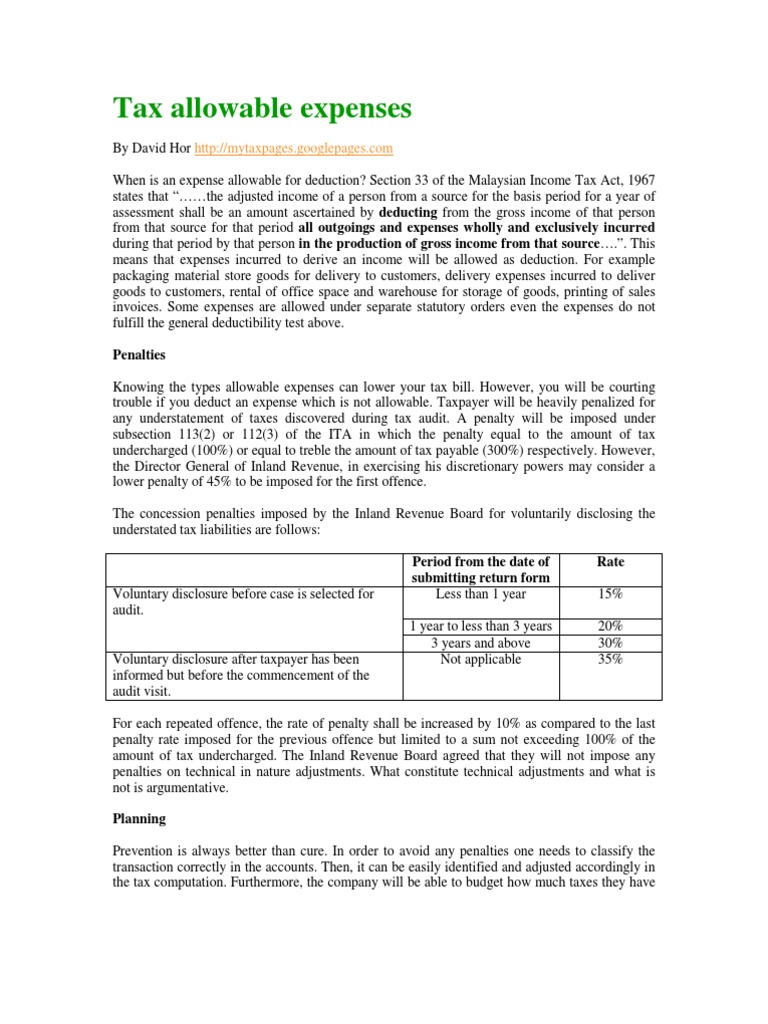

The rules prescribe that a deduction for the following expenses incurred and paid by a person resident in malaysia shall be allowed in ascertaining the adjusted income of its business in the basis period for a year of assessment ya.

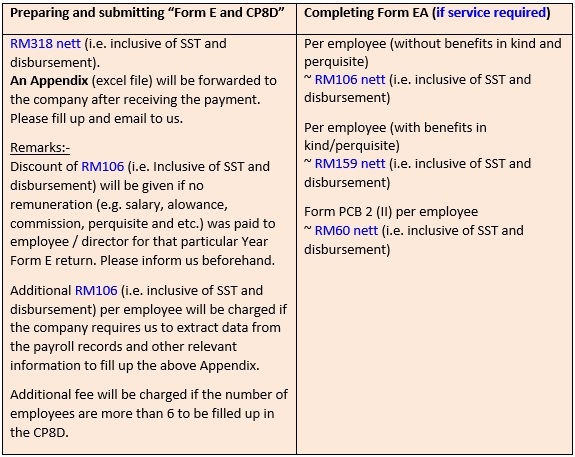

Secretarial fee tax deduction malaysia 2018. Tax deduction on secretarial fee and tax filing fee effective from ya 2015 specific tax deduction is given for secretarial fees and tax filing fees up to rm5 000 and rm10 000 respectively for each ya. Section 26 of the sales tax act 2018. For a course of study in malaysia up to tertiary level undertaken to acquire law accountancy islamic financing technical vocational industrial scientific or technological skills or. The inland revenue board irb has issued its guideline dated 8 february 2017 on the tax deductionof secretarial and tax filing fees under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 the rules.

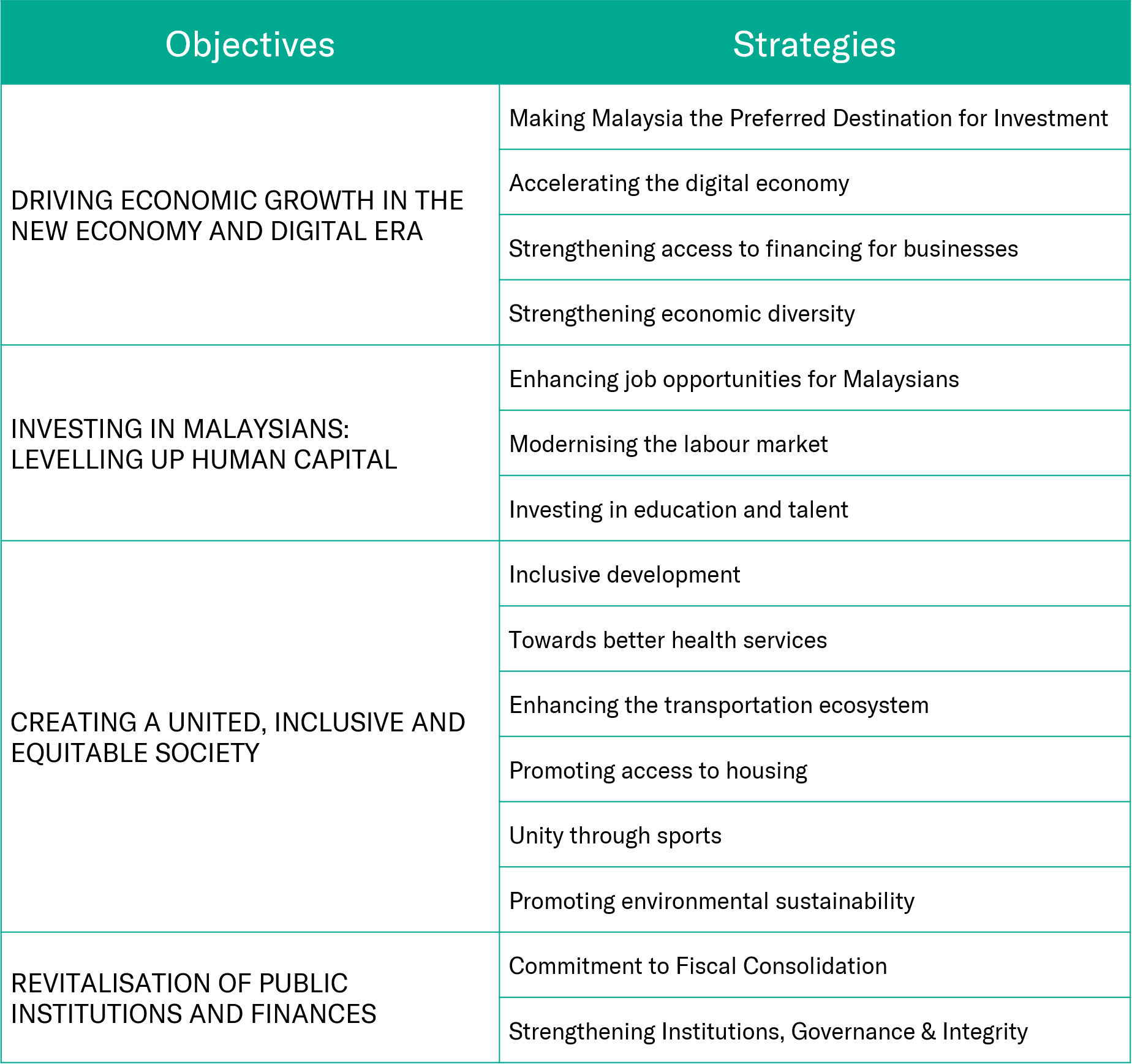

Education fees for self. Amended guideline on deduction for expenses relating to secretarial fees and tax filing fees. It is proposed that the tax deduction limit for secretarial fees and tax filing fees be combined and allowed up to rm15 000 for each ya. Special deduction for secretarial and tax filing fees the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 has been gazetted on 17 december 2014.

The guideline explains the tax treatment for deductionof secretarial and filing fees. The rules allow deduction for secretarial fee and tax filing fee to a person resident in malaysia as follows. For a degree at masters or doctorate level for purposes of acquiring any skill or qualification. With this the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u.

A 336 are revoked. Secretarial fee charged in respect of secretarial services provided by a company. Section 19 of the tourism tax act 2017. The tax filing fee must be charged by a.

Malaysia taxation and investment 2018 updated april 2018 3 principal hubs the government has issued detailed guidelines including the revised guidelines for principal hubs dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia. Following the issuance of a guideline for deduction of secretarial and tax filing fees dated 17 august 2018 numerous clarification had been sought by taxpayers and professional bodies on the uncertainty in relation to the deductibility of such fees. Secretarial fee the deduction shall be allowed with effect from ya 2015. 25 september 2018 issue 8 2018 in this issue public ruling 3 2018 qualifying expenditure and computation of industrial building allowances new public rulings on taxation of resident individuals amended guideline on deduction for expenses relating to secretarial fees and tax filing fees.

Tax espresso september 2018 3 2nd amended guidelines on deduction for expenses in relation to secretarial fee and tax filing fee revised as at 17 08 2018 the inland revenue board of malaysia irbm has on 17 august 2018 issued a 2nd amended guidelines on deduction for expenses in relation to secretarial fee and tax filing fee revised as.

%20order%202017-page-001.jpg)

%20for%20ya%202019-page-001.jpg)